One of the first things they teach you in microeconomics is the concept of reversion to the mean. Companies earning high economic profits will eventually meet competition. The competition will lead towards a more normal profit. But some companies defy logic and deliver extraordinary returns over a long period. Coloplast belongs in that category.

1. Company description

The journey of Coloplast began in the early 1950s. Elise Sørensen, a nurse, experienced the negative influence of ostomy on her sister Thora. Thora had had an ostomy operation and was afraid to go out in public for fear that her stoma might leak. The problem gave Elise the idea of the world’s first adhesive ostomy bag.

Coloplast was founded in 1957 with the mission, “To make life easier for people with intimate healthcare needs”. Listening to customer needs is essential to make people’s life easier. With the vision, “Setting the global standard for listening and responding”, Coloplast demonstrates its customer-centric focus. Today, Coloplast’s business consists of five segments: Ostomy Care, Continence Care, Wound & Skin Care, Interventional Urology, and Voice & Respiratory Care.

Financial development

Since the 1950s Coloplast has developed into one of the most valuable companies in Denmark. Helping millions of people globally, the company reported revenues of 22,5 billion DKK in 2021/22. Growing 16% YoY and 6% organically. Coloplast is a highly profitable business and reported a gross profit margin of 69% in 2021/22. The EBIT was 6,4 billion DKK corresponding to an EBIT margin of 29%. The EBITDA margin was 33%.

The number of full-time employees grew 9% from 12.578 in 2020/21 to 13.650 in 2021/22. Driven by 1.200 additional employees from Atos Medical. The financial statements were influenced by the acquisition of Atos Medical. The acquisition was funded through debt financing. More precisely, 16.359 billion DKK was raised through debt. The NIBD/EBITDA ratio was 0,3 in 2020/21 and is now 2,3.

Acquisition of Atos Medical

In January 2022, Coloplast completed its largest acquisition to date. Atos Medical was acquired at the price of 16 billion DKK. The acquisition gives access to a new business segment, Voice & Respiratory Care. The Voice & Respiratory market size is around 1-1.5 billion DKK and Atos Medical has a market share of 85%. This business segment is expected to grow 8%-10% organically per year. Atos Medical shares many similarities with Coloplast. Both companies are market leaders in their retrospective markets. They both serve chronic users. Atos Medical’s EBITDA margin was in the mid-30s which is similar to Coloplast.

Kristian Villumsen (CEO) said the following about Atos Medical, “Atos Medical is a chronic business that fits into Coloplast’s mission, vision, and values. When you take a closer look at Atos Medical, you’ll quickly see that there are many similarities between their business and our chronic care businesses, Ostomy Care, and Continence Care. There are similarities from a patient perspective, but our commercial models are also similar and centered around category leadership through innovation, strong relationships with healthcare professionals, and a direct-to-consumer set up.”(Acquisition Call, 08-11-2021).

From a growth perspective, the acquisition makes sense. Whether the acquisition will be value-creating is hard to tell at this point. The cost synergies are expected to be around 100 million DKK and are not that impressive. Coloplast’s ROIC will be negatively impacted by the acquisition. Before the acquisition, the company had a ROIC of around 40-50% and it’s now in its mid-twenties.

Other events

Coloplast is expected to launch two new products, Heylo and Luja, in 2023. Heylo is a digital leakage platform. 91% of people living with a stoma worry about leakage (Coloplast Roadshow 2021/22). The platform will notify you if leakage is likely to happen. Luja is a new male intermittent catheter that addresses important urinary tract infections through Micro-hole Zone Technology. Urinary tract infections are one of the biggest challenges for people using catheters.

Corporate culture

Coloplast had an employee engagement score of 8,2 out of 10 in FY 2021/22. The employee engagement score measures employees’ well-being. The score was above the healthcare industry benchmark. The company tries to develop talented individuals into leadership positions. In 2021/22, 85% of critical management positions were filled by internal candidates (Coloplast Annual Report 2021/22). The culture in Coloplast’s own words,

“We want to foster a culture where every individual feels engaged and is empowered to make decisions. In addition, and as part of our leadership promise, we continue to create an inclusive workplace.” (Coloplast Annual Report 2021/22).

2. Industry description

2.1 Introduction

Coloplast operates as a manufacturing company in the healthcare industry. Coloplast will buy materials (plastic, rubbers, etc.) from a supplier. Materials are mostly homogenous and the number of suppliers is many. Making it relatively easy to switch suppliers if necessary. Coloplast has production plants in Denmark, the USA, Costa Rica, France, Hungary, and China. The production volume of each country is shown below:

Source: Source: Roadshow presentation FY 2021/22. Slide 94.

Coloplast is highly reliant upon production in Hungary. That has been an issue as of late due to high inflation in Hungary. Coloplast plans that Costa Rica, in 2025, will account for 25% of production. That would make Coloplast’s manufacturing setup more diversified.

When the products are finished, Coloplast will sell to Group Purchasing Organizations (GPOs), hospitals, pharmacies, and sometimes directly to the consumer.

The company uses the following illustration to describe how its business works:

Source: Roadshow presentation FY 2021/22. Slide 66.

It will likely be in the hospital, that a patient is introduced to Coloplast’s products. As customers tend to be loyal to the first product they use it’s important to be the hospitals’ preferred solution. Most of Coloplast’s products are sold in markets where the consumer can be reimbursed by local healthcare authorities. The prices are therefore influenced by economic and political development. Sales processes are different from country to country. Sales processes are explained in section 2.3.1.

2.2 TAM

As mentioned earlier, Coloplast operates in 5 segments. The market shares of each segment and expected growth are shown below from Coloplast’s presentation:

Source: Roadshow presentation FY 2021/22. Slide 21.

Given the information, it’s possible to estimate Coloplast’s total market share[1]. Coloplast’s total market share is estimated to be 26%. Most segments are expected to grow at around 5% in the coming years. Voice & Respiratory Care is the fastest-growing segment and is expected to grow at 8-10% annually. It’s expected that Coloplast will gain market share in the coming years as management expect revenue to grow organic at 7-9% annually.

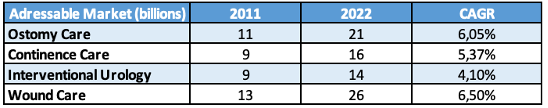

Looking at the historical development of the addressable market, the growth has been stable at around 4-6%:

Source: Coloplast 2010/11 & 2021/22 annual report.

So, the expected growth in the addressable markets seems reasonable.

An aging population and expanded healthcare coverage in emerging markets are considered to be the two most important growth drivers. Both growth drivers have the potential to increase Coloplast’s total addressable market. In the last strategic period, Lead 20, Coloplast played a significant role in expanding healthcare coverage,

”Over the lead 20 period, we also worked with many government affairs authorities to establish new reimbursement policies for intermittent catheters particularly in big Asia Pacific markets, Japan, South Korea and Australia.”. (Paul Marcun (EVP growth), Capital Markets Day 2020). This shows that Coloplast has great influence and lobbying skills.

On the other hand, price reduction is a real threat. New healthcare reforms could deduct reimbursement and leave Coloplast with no other option but to reduce prices. However, in the short term, this scenario seems unlikely,

“But on the other hand, we also have a lot of focus on increasing prices across our business also into next year. As we mentioned earlier this year, we are expecting positive price impact this year and I'm actually also expecting that for next year also because we are not looking at any bigger healthcare reforms.” (Anders Lonning-Skovgaard (CFO), Q3 2022 earnings call).

Another growth limiter is earlier detection and cure. If surgeons can fully heal patients, there is no need for Coloplast’s products. This is a very speculative and long-term risk and nothing to be worried about at this point. To summarize, the threat from growth limiters looks minimal.

2.3 Segments

2.3.1 Geographical split

Before we dive into Coloplast’s product segments, we will have a closer look at the geographical revenue split and the difference in sale channels:

Source: Coloplast Annual Report 2021/22.

Other developed markets cover nations such as the USA, Canada, Japan, Australia, and New Zealand. China is part of the emerging market segment and it’s the fastest-growing segment. The ambition for Chronic Care in China is to outgrow the market (>15% annually). And the ambition for Chronic Care in the US is to grow revenues above 10% annually. In Europe, high single-digit growth is the ambition (Capital Markets Day 2020). An overview of Coloplast’s market share for each segment and region is shown below:

Source: Coloplast Annual Report 2021/22.

Coloplast is the market leader in most of the segments in Europe. The company is slightly less dominant in emerging markets but is still the market leader in most of the segments as well. There is room for improvement in the developed markets. An effort is made in the US where the company wants to go from challenger to leader. Overall, Coloplast is very strongly positioned.

Each region requires its own focus as sales processes are different. In Europe, the patient will be hospitalized longer than in the US and China. This means, that European consumers often will stay loyal to the product they were introduced to at the hospital. Sales to hospitals are therefore of critical importance. More than 95% of the products in Europe are fully reimbursed (Region Europe, Capital Markets Day 2018). But only some products are eligible for reimbursement. In Denmark, you’re only fully reimbursed if you choose the products dictated by the municipal. The state selects the cheapest product that fulfills the patient’s needs according to §112 in the Danish Service Law.

In the US, the patient has more freedom to choose. The hospitalization period is shorter. This means, that product loyalty often happens after hospitalization. The following illustration describes the typical ostomy patient’s treatment process in the US:

Source: Coloplast Meet The Management – US Chronic Care (2022)

Coloplast is targeting Group Purchasing Organizations (GPOs) to be part of the short acute treatment period. The acute period will likely be the patient’s first introduction to ostomy products. Looking back, Coloplast wasn’t a part of the GPOs but that has changed in the past couple of years. Coloplast has won some major acute GPOs with Premier and Vizient. Together they have a market share of around 75% of the US acute market.

After the acute phase, it’s important to maintain a strong relationship with the consumer. New digital platforms and Coloplast Care are improving customer loyalty.

In China and other emerging markets, public healthcare is not as comprehensive. The consumer will often pay from their own pocket. A direct relationship with the consumer is therefore of more importance.

2.3.2 Products

Today, Coloplast operates in multiple segments. The segments are Ostomy Care, Continence Care, Wound & Skin Care, Interventional Urology, and Voice & Respiratory Care. The revenue split of the segments is:

Source: Coloplast Annual Report 2021/22.

The two most important segments are by far Ostomy Care and Continence Care as they respectively account for 38% and 34% of the total revenue. A short description of the different segments is provided below.

Ostomy Care

A stoma is created by surgery. The surgent redirects a part of the intestine through an opening in the abdominal wall. This allows the feces to leave the body through the abdomen. The patient needs an ostomy bag that collects the feces from the stoma. Coloplast provides these ostomy bags. Examples of products are shown below:

Source: Roadshow Presentation FY 2021/22. Slide 79.

The customers of these products could be nurses, people with a stoma, wholesalers/distributors, hospital purchasers, and GPOs, and surgeons (Roadshow Presentation FY 2021/22). Ostomy Care is part of the Chronic Care segment. People with a stoma will on average use a stoma pouch for 10 years. The long customer lifetime means that less than 10% of the sales come from hospitals. But customers tend to be loyal and continue to use the products they were introduced to at the hospital. Therefore, sales to hospitals are of critical importance (Coloplast Annual Report 2021/22).

A set of 10 Sensura Mio Concave cost 845 DKK on Coloplast’s website. And a set of 10 Sensura Mio Convex cost 658 DKK. In general a stoma bag from Coloplast costs around 40-100 DKK. Depending on the type of bag you would probably change it at least once a day.

Continence Care

Continence Care is the other segment of Chronic Care. It addresses two issues: people who aren’t able to empty their bladder and people who can’t retain urine or feces. Coloplast offers catheters and bags to collect urine and feces:

Source: Roadshow Presentation FY 2021/22. Slide 81.

The customers would typically be continence or home care nurses, wholesalers/distributors, hospital purchasers, and GPOs (Roadshow Presentation FY 2021/22). This segment has most of the same characteristics as Ostomy care. Again, less than 10% of sales are made through the hospital. Consumers tend to be loyal to the products they were introduced to at the hospital. Being the hospital’s preferred option can lead to a long period of recurring revenues. Because a user of an intermittent catheter will on average use catheters for 30 years.

A set of 30 SpeediCath Flex cost 788 DKK. Corresponding to 27 DKK a piece. A normal person would probably use a catheter 4 to 6 times a day. Generating daily revenue of 100-180 DKK.

A set of 30 SpeediBag (urine bag of 700 ml) cost 203 DKK. Equal to 7 DKK a piece. A normal person urinates 800-2.000 ml a day. So, you would use at least 2 bags per day.

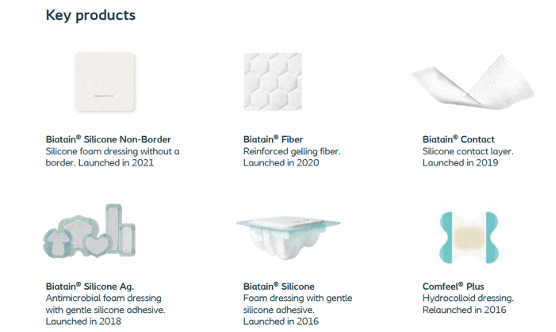

Wound & Skin Care

Patients in the Wound Care segment are treated for chronic wounds such as leg ulcers, pressure ulcers, or diabetic foot ulcers. Coloplast sells products that are optimal for healing the type of wounds mentioned before. The key products in Wound Care are shown below:

Source: Roadshow presentation FY 2021/22. Slide 86.

The typical customers are hospitals and clinics. The cost of the products is between 10-100 DKK a piece.

In Skin Care, Coloplast provides products that can heal and prevent skin damage from incontinence, moisture, skin folds, and obesity. Key products are:

Source: Roadshow presentation FY 2021/22. Slide 87.

The typical customers are hospitals and clinics. A 60 ml Comfeel tube costs 58 DKK.

Interventional Urology

There are four underlying segments of Interventional Urology: Men’s Health, Women’s Health, Endourology, and Bladder Health. Men’s health is about treating erectile dysfunction. In Women’s health, women are treated for pelvic organ prolapse and stress urinary incontinence. Patients are treated for kidney stones and other urological conditions in Endourology and Bladder Health. Almost half of the revenue in Interventional Urology comes from the Endourology segment and the remaining half of revenue is split equally between Men’s Health, Women’s Health, and Bladder Health. The key products are:

Source: Roadshow presentation FY 2021/22. Slide 85.

Customer groups are often surgeons, GPOs, and end customers. Most of the products are used during surgery and are not possible to buy direct from the website.

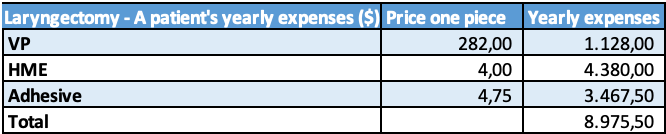

Voice & Respiratory Care

Voice & Respiratory Care is Coloplast’s newest segment. The segment was added through the acquisition of Atos Medical. Two-thirds of the revenue comes from laryngectomy and one-third from tracheostomy. A laryngectomy is a procedure where the voice box is removed. The patient then relies on a Voice Prosthesis (VP) to speak. The patient breaths through a stoma in the throat and relies upon Heat- and Moisture Exchangers (HMEs). Laryngectomy is a chronic disease and on average a patient will use the before-mentioned products for 8-10 years. Key products are shown below:

Source: Roadshow presentation FY 2021/22. Slide 83.

It’s recommended to change the VP 3-4 times a year, the HME 2-3 times per day, and the adhesives 1-2 times per day. One Provox Vega Voice Prostheses costs $282 on Atos Medical’s website. A 30-piece Provox Life Home HME costs $120. So, $4 a piece, and you would need 3 a day. A 30-piece Provox Life Adhesive Standard costs $142. $4,75 a piece and you need to change it 1-2 times a day (Coloplast Annual Report FY 2021/22). Given this information, we can approximate the yearly expenses of a patient.

Source: Coloplast Annual Report FY 2021/22 & Atos Medical Website.

A tracheostomy is a procedure where an opening in the throat is created. This is done to facilitate breathing. The disease can be permanent or temporary. 1 million procedures are done each year and on average one-third of the patients use tracheostomy products for more than six months. The patient will get a cannula inserted by a surgeon and apply HME themselves. The use of HME for tracheostomy is less prevalent than for laryngectomy (Coloplast Annual Report FY 2021/22). Key products are:

Source: Roadshow presentation FY 2021/22. Slide 84.

The customers for both segments will likely be hospitals, surgeons, GPOs, and the end consumer.

2.4 Competition

Even though Coloplast has a strong market position and is market leader in most markets we need to consider the key competitors. As Coloplast operates in five different segments, we will look at market shares for each segment. Most of Coloplast’s competitors are private companies that don’t announce revenue figures. That makes it difficult to figure out the exact market share. So, the private companies are grouped together and take on the residual market share. LTM revenue figures are used for each company to estimate the market share of the addressable market.

Ostomy Care

The addressable market is estimated to be 21 billion DKK. The major competitors in this segment are Hollister Incorporated and Convatec. Coloplast is the undisputed market leader with a market share of around 40%.

Source: Coloplast Annual Report FY 2021/22, Convatec Interim Results August 2022.

Convatec is the third largest company in the Ostomy Care segment. Hollister is the second largest (Convatec Capital Markets Day 2022). Hollister is expected to have a market share of at least 18%.

Continence Care

The addressable market is estimated to be 16 billion DKK.

Source: Coloplast Annual Report FY 2021/22.

Coloplast has a market share of around 48% and is the market leader. Wellspect, Bard Care, and Hollister are Coloplast’s main competitors. Ostomy- and Continence Care are consolidated markets with a few large competitors.

Wound Care

The addressable market is estimated to be 26 billion DKK. Coloplast is the 5th largest Wound Care company.

Source: Coloplast Annual Report FY 2021/22, Smith & Nephew Annual Report FY 2021, Convatec Interim Results August 2022, Mölnlycke Annual Report FY 2021.

This market is more fragmented than Ostomy- and Continence care and Coloplast has room for improvement. Convatec is a close competitor to Coloplast in the Wound care market as they were in the Ostomy care market.

The skin care market size is estimated to be 4-5 billion DKK and Coloplast has a market share of 10-15% (Coloplast Annual Report FY 2021/22).

Interventional Urology

Interventional Urology has an estimated market size of 14 billion DKK according to Coloplast. Coloplast is the 4th largest manufacturer with a market share of 15-20%. In the last twelve months, Boston Scientific has reported revenues of $1.737 million in Urology and Pelvic Health. Using the exchange rate from the last reporting date gives us revenues of 13 billion DKK. Coloplast reported revenues of 2,4 billion DKK in the urology segment. Adding the numbers together takes us above Coloplast total addressable market size. We would need more detailed information about the market size and revenue to estimate the competitors’ market share. But it’s fair to conclude that Boston Scientific is the biggest competitor together with Johnson & Johnson, Cook Medical, and BD. Coloplast has a market share of 15-20%.

Voice & Respiratory care

With the acquisition of Atos Medical, Coloplast bought itself into a lucrative position as market leader with 85% market share in the Voice & Respiratory Care segment.

Source: Coloplast Annual Report FY 2021/22.

With a market position like a monopoly and expected annual growth of 8-10%, Coloplast is nicely positioned in the Voice & Respiratory Care segment.

Conclusion Competition

Due to the fact that most of the segments are consolidated with few competitors, it’s fair to assume that the high industry margins will continue. The only real threat to high margins is healthcare reforms and regulations. Looking more specifically at Coloplast. The company has only ever gained market share and is market leader in the most important markets (Ostomy and Continence Care). There is no reason to believe that Coloplast can’t keep gaining market share and strengthen its position even further.

3. Business model

3.1 Moat

Coloplast possesses several competitive advantages that make it incredibly hard for competitors and new entrants to gain market share. Economies of scale, switching costs, and brand are the company’s most important competitive advantages.

Economies of scale

Coloplast is the market leader in Ostomy- and Continence Care. The high fixed cost of running a healthcare manufacturing business (manufacturing plant, R&D, etc.) is split among millions of units. It would require huge capital investments for new entrants to compete with the quality and price of Coloplast’s products. Coloplast spent more than 850 million DKK on R&D in 2021/22 corresponding to around 4% of revenues. R&D spending will only increase as revenue increases. Smaller competitors and new entrants simply don’t have the same financial power to compete. There is a reason why the markets are so consolidated. It’s just not economically attractive for outsiders to enter the Chronic segments Coloplast is in.

Switching costs

The company operates in segments that are known for high customer loyalty. Once a customer has been introduced to a product that works, the customer tends to keep using that product throughout his or her life. Coloplast’s products are helping people with chronic diseases. People don’t want to change products unless the new product is substantially better than the one they use. The same can be said about hospitals and GPOs. They want to buy and use the highest quality products at the lowest possible price. In “Zero to One”, Peter Thiel, argues that a product needs to be 10X better than the existing product to move over customers. It’s hard to imagine a competitor’s product being 10X better than the products Coloplast offers. Coloplast has only ever gained market share because there is no reason for a customer to switch to a new brand.

Brand

Coloplast is the 14th most valuable brand in Denmark (Branddirectory, 2022). In the healthcare industry, it’s important that the consumer is comfortable with your brand. Furthermore, it’s easier to negotiate deals with GPOs and hospitals if you have a strong brand with a good track record. It was a strategic focus in the Lead20 period to make Coloplast more consumer-focused. In the US, consumers can freely select the products they want to use. Coloplast Care has been a great way to connect with consumers and strengthen the position in the US. The program gives users access to advice from professionals and an introduction to the newest products. The program has over 2 million users and is present in more than 30 countries. Due to Coloplast Care, one-third of every new American ostomy patient will try Coloplast’s products (BLS Invest, 2022). Coloplast Care is also a great way to understand customer needs and collect data. That is a crucial part of innovation.

Conclusion Moat

Coloplast’s competitive advantages look sustainable. The company has gained market share over the past many years and has managed to keep high margins. Coloplast has the best products, can spend more on R&D, and has a better understanding of consumers’ needs. Giving the consumers no reason to switch away from Coloplast. Nothing indicates that Coloplast’s position is threatened.

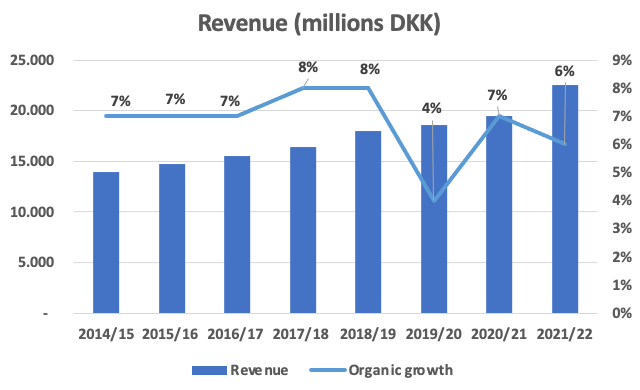

3.2 Revenue growth

Coloplast has managed to increase its revenue from 13.909 million DKK in 2014/15 to 22.579 million DKK in 2021/22. That corresponds to a CAGR of 7,17%. The company has made some acquisitions along the way and the organic growth rate is therefore relevant to look at:

Source: Coloplast Annual Reports.

The addressable market has grown annually by 4-5% and Coloplast has managed to outgrow that organically. It’s expected that the addressable market will keep growing at 4-5% until 2024/25. The company expects to outgrow the market with an annual growth rate of 7-9% until the end of 2024/25 (Coloplast Annual Report FY 2021/22). Even though Coloplast expects a slight price increase next year, the growth will primarily come from increased volume. China and the US are countries where Coloplast has gained market share in the past couple of years and there is still plenty of room for growth. Additionally, M&A will play an important role in the company’s future growth.

Coloplast operates in industries with high predictability and stability. Using the table presented earlier in the analysis:

Source: Coloplast 2010/11 & 2021/22 annual report.

The annual growth has been around 4-6% as Coloplast earlier predicted. And we should probably expect the same growth rates going forward.

3.3 Profitability

Like the revenue, the profitability of Coloplast has been predictable and stable:

Source: Coloplast Annual Reports.

The company has maintained an Operating Margin of around 30% since 2014/15. And Coloplast plans to keep an Operating Margin above 30% in the strategic period ending 2024/25. R&D is mostly fixed at around 4% of revenue and they expect to invest 2% of revenues on incremental OPEX investments. The EBITDA margin before special items was 32% and the net profit margin was 21% in FY 2021/22.

Due to inflation in raw materials and wages in Hungary, Coloplast is expecting an operating margin between 28-30% in 2022/23. These headwinds shouldn’t be an issue in the long run:

“We continue to strive for unparalleled efficiency and industry-leading margins. This year, we opened our second volume factory in Costa Rica. Ramp up is ongoing and by the end of Strive25, Costa Rica is expected to account for around 25% of volumes, allowing for a more robust and global production network. We're also making solid progress on our automation program, which is on track to deliver FTE neutrality in 2022-2023 with a net impact of around 1,000 FTEs.” (Anders Lonning-Skovgaard (CFO), Q4 2022 Earnings Call).

Normalization in China, inflation decline, and reimbursement improvement would improve profit margins.

Coloplast has far better margins than their peers:

Source: Annual Reports of the respective companies. *=2021 numbers.

Looking at the LTM, Coloplast has had an operating margin of 31% (29% after special items). Most of Coloplast’s competitors have operating margins in the low double digits. Again, this just shows the superiority of Coloplast. But it’s important to notice that none of the companies are exactly alike and it’s difficult to compare them.

3.4 Earnings growth

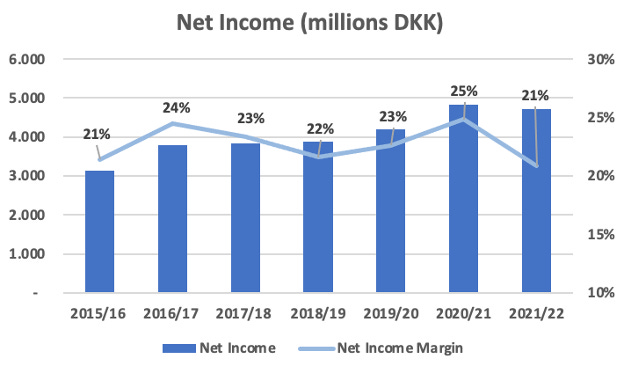

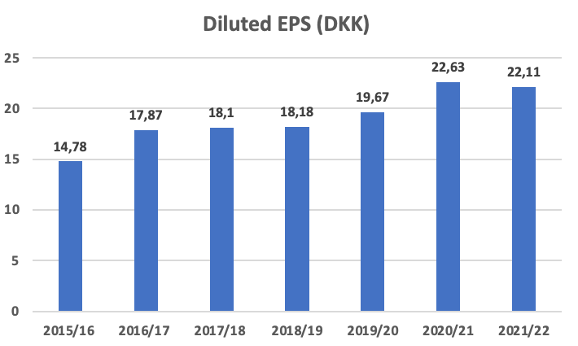

Coloplast’s net income has grown with a CAGR of 7% since 2015/16. Earnings growth has been very close to revenue growth:

Source: Coloplast Annual Reports.

Again, Coloplast looks very stable and has produced net income margins above 20% since 2015/16. Diluted EPS has followed net income with a CAGR of 7% as outstanding shares have remained more or less the same:

Source: Coloplast Annual Reports.

3.5 Capital Intensity and returns

Net working capital (NWC) was 25% of revenue in 2022 up 1pp from 24% in 2021:

Source: Coloplast Annual Reports.

The NWC requirement has been stable at around 23-25% of revenue since 2014/15. NWC was up from the prior year due to an increase in safety stocks on raw materials, inflation, and Atos Medical.

Looking at the development in CAPEX:

Source: Coloplast Annual Reports.

Coloplast spent 927 million DKK on CAPEX in 2021/22 translating to 4% of revenue. Coloplast’s CAPEX spending has been stable at around 4-5% of revenue since 2014/15. CAPEX and NWC requirements for Coloplast are very predictable and stable. The unknown factor is M&A spending. Coloplast made its biggest acquisition last year of Atos Medical. The following table shows the most important acquisitions:

Source: Coloplast Annual Reports.

Historically, Coloplast hasn’t been very acquisitive. They spent a lot on Mentor’s urology business in 2006 but they didn’t make any major acquisitions until 2021. Going forward we should expect Coloplast to be more acquisitive. The company has built a stronger M&A department. At the Capital Markets Day in 2020, they presented the new Strive25 strategy and part of that strategy is M&A. More specifically, we should expect acquisitions within Interventional Urology,

“I'd also say that for the IU business area we are more active than in the other two at the stage. This is an absolutely critical component of revitalized and rebuilding the pipeline. And we can't really succeed with the long-term ambition that we have for that particular business without getting into much more business development and M&A than we have historically.” (Kristian Villumsen (CEO), Capital Markets Day 2020).

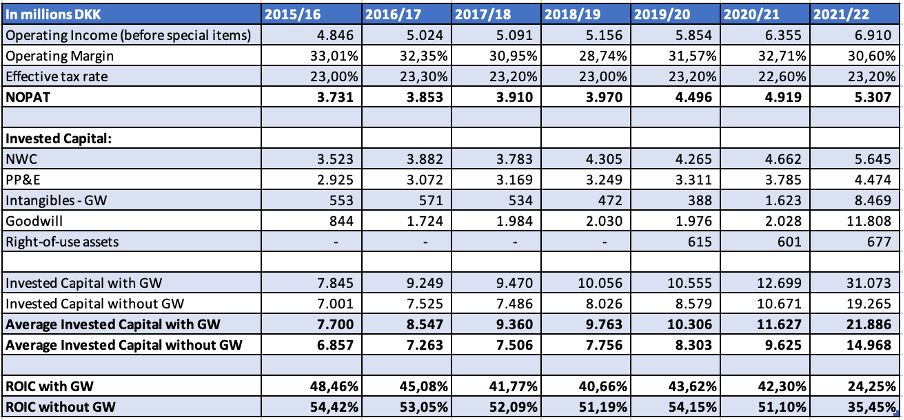

ROIC

Coloplast is known for its high ROIC as the company has delivered ROIC above 50% for a long time. But we shouldn’t expect ROIC of around 50% anytime soon. Coloplast’s ROIC has been negatively influenced by the acquisition of Atos Medical,

“So as a consequence of this acquisition, the ROIC for the combined companies will be changed. And the way we look at it currently is that the ROIC will probably be something mid-20s by the end of this strategic period as a consequence of the acquisition.” (Kristian Villumsen (CEO), Acquisition Atos Medical).

The ROIC with and without goodwill has been calculated in the table below:

Source: Coloplast Annual Reports.

As the table shows Coloplast has consistently delivered ROIC above 40% with goodwill and above 50% without goodwill. But after the major acquisition of Atos Medical the ROIC has declined to 24% with goodwill and 35% without. We should expect future ROIC to be in the same range as the ROIC from 2021/22. At least until 2024/25. Afterwards, we could see an improvement in ROIC,

“It (ROIC) will take a hit as a consequence of the acquisition and we estimate it to be in the mid-20s by the end of this strategic period and then it will increase from there.” (Kristian Villumsen (CEO), Acquisition Atos Medical).

3.6 Free cash flow

Coloplast has generated the following free cash flow to the firm (FCFF):

Source: Coloplast Annual Reports.

Coloplast’s FCFF has grown with a CAGR of 6% from 2014/15 to 2021/22. That is 1pp lower than the growth in net income. After the previous sections, it should come as no surprise that Coloplast converts almost all of net income to FCFF. CAPEX spending is low and the same is working capital requirements.

4. Capital allocation

Coloplast has consistently had a payout ratio of more than 80% of profits. This payout has included annual share buybacks of 500 million and dividends as the residual value:

In the long run, Coloplast plans to have a payout ratio of 80-100% with annual share buybacks of 500 million. But the payout ratio will change if the company is acquisitive. After the Atos Medical acquisition, the focus is now on deleveraging the balance sheet,

”We will focus on deleveraging the balance sheet and our target is to be within the one to two times interest-bearing bearing debt to EBITDA by the end of Strive25 period.” Anders Lonning-Skovgaard, Acquisition of Atos Medical)

The historical net debt to EBITDA ratio has been:

Source: Coloplast Annual Reports.

Due to the increase in NIBD/EBITDA ratio, the company will lower the payout ratio to 60-80% until the NIBD/EBITDA ratio is within one to two.

Looking closer at dividends:

Source: Coloplast Annual Reports.

The company pays out dividends bi-annualy and currently has a dividend yield of 2,4% (Share price of 837,6 DKK).

Returns

Coloplast’s share price has done extremely well compared to peers:

Source: Coloplast Investor Relations.

The share price of Coloplast increased 778% from the start of 2010 to the 1st of February 2023. That corresponds to an extraordinary CAGR of around 18%.

Looking at more recent share price data:

Source: Coloplast Investor Relations – 02/02-2023.

Over a 5 year period, Coloplast has outperformed most peers (except Boston Scientific).

5. Valuation

Using the FCFF from before, Coloplast trades at FCFF yield of 2,3% (Market Cap=117 billion DKK). Assuming the company grows FCFF by 6% the FCFF yield is 2,4%. The company has a public reputation for being expensive. That’s the case for most quality companies.

Looking at the historical FCFF yield:

Source: Coloplast Annual Reports & Companiesmarketcap.com.

Comparing the current FCFF yield with the historical FCFF yield, the company is neither expensive nor cheap. Of course, Coloplast seems expensive compared to others but as mentioned before, Coloplast is a quality company.

The current P/E ratio of Coloplast is 38 (Market Cap=117 billion DKK) and the forward P/E ratio is 34 (expected next year earnings). The historical P/E ratio has been around 30-40:

Source: Coloplast Annual Reports & Yahoo Finance.

Again, Coloplast is neither expensive nor cheap compared to past P/E ratios.

As mentioned earlier Coloplast has a dividend yield of 2,4% (Share price of 837,6 DKK). Coloplast has historically bought back shares for 500 million annually. The share buyback yield is 0,3%. Hence the Div/SBB yield is equal to 2,7%.

6. Management

Executive management

The following table gives a brief overview of Coloplast’s executive management team:

Source: Coloplast.com & LinkedIn.

Most of Coloplast’s executive management team has been with the company for a long time. That is something the company is proud of and wants to continue with,

“We'll be securing talent for future through strong succession planning for critical managerial decisions and through targeted development programs across all levels of the organization with a focus on pipeline building through attraction of talent and development of talent.” (Camilla Mohl (former Senior Vice President People & Culture), Capital Markets Day 2020).

The total remuneration of the executive management was 62 million DKK in 2021/22. Same as last year:

Source: Coloplast Remuneration Report 2021/22.

These wages look standard compared to other C25 companies. Looking closer at the share options:

Source: Coloplast Remuneration Report 2021/22.

The market value of the share options held by management at year-end was 54 million DKK. It’s nice to know that management has skin in the game. Additionally, Kristian Villumsen holds 90.691 class b shares. That corresponds to a total value of 76 million DKK (Share price of 837,6 DKK). Creating shareholder value is in the CEO’s best interest.

Remuneration of management consists of short and long-term fixed and variable components. The fixed remuneration is a fixed base salary, pension and other benefits. The variable remunerations is a cash bonus of maximum 35% of fixed remuneration. Including a share option plan with a fair value at the time of the grant corresponding to up to twelve months base salary including pension. The remuneration is determined based on a benchmark against peers (Coloplast Remuneration Report 2021/22).

The criteria for receiving the cash bonus are based on financial and sustainability targets. Financial targets are revenue growth and operating profit margin. Each target has a weight of 45%. The last weight of 10% comes from sustainability targets. Sustainability targets in 2021/22 were power purchase agreements for electricity and phase out of natural gas at site (Coloplast Remuneration Report 2021/22).

Coloplast could have made remuneration even more aligned with shareholder interest if they had included metrics like ROIC and FCF. The current metrics say nothing about debt. Management could be incentivized to achieve revenue growth by taking on a lot of debt. That wouldn’t necessarily create shareholder value. But since management has skin in the game it should be in their best interest to create shareholder value.

Board of Directors

The Board of Directors play an essential role as they are overseeing and advising the business. Coloplast presented the following description of their Board of Directors at the Capital Markets Day in 2020:

Source: Coloplast Capital Markets Day 2020.

The Board of Directors have been at Coloplast for a long time. Lars Rasmussen was CEO at Coloplast for 11 years before taking on the role as Chairman of the Board in 2018. Lars Rasmussen holds 207 thousand class B shares at a market value of 176 million DKK (Share price of 837,6 DKK). Niels Peter Louis-Hansen (Deputy Chairman) holds 12 million class A shares and 34 million class B shares. Equivalent to a market value of more than 35 billion DKK. The Deputy Chairman is the son of Coloplast founder Aage Louis-Hansen. Niels Peter Louis-Hansen owns 20,7% of the company and has voting rights of 41,1% (Coloplast Annual Report 2021/22). It’s fair to conclude that it’s in the interest of the Board of Directors to create long-term shareholder value.

7. Risks, threats, and weaknesses

Coloplast’s business has historically delivered stable and predictable growth. There isn’t a lot indicating that should change anytime soon. The competition will always be a threat. But it’s a minimal threat to Coloplast. Coloplast has a market leader position with a high degree of loyalty from customers. Competitors would have to invent something brand new in order to threaten Coloplast’s market position. That seems unlikely. Current risks primarily evolve around China and inflation. But over the long run, these risks aren’t something to be worried about. Lower reimbursement prices are often a focus on earnings calls and in annual reports as a potential risk. Coloplast expects a negative price impact of -1% in the medium to long term (Coloplast Annual Report 2021/22). Again, this shouldn’t be an issue with the expected increase in volume. The biggest risk of Coloplast comes from within.

M&A

With the acquisition of Atos Medical, the company has started a strategic period with an increased focus on M&A activities. Generally speaking, most acquisitions are value-destroying. Management is too optimistic about revenue synergies and ends up acquiring a company at a too high premium. Coloplast paid 16 billion DKK for Atos Medical. Atos Medical had revenues of 1,2 billion DKK and an EBITDA margin in the mid-thirties in 2021/22. That gives us an EV/EBITDA ratio of around 38. It’s fair to conclude that the acquisition wasn’t cheap. As mentioned earlier in the analysis, the acquisition also had a negative influence on ROIC. Management should be careful that they’re not diluting and worsening the high return company that Coloplast has been. Future M&A activities are something that investors should follow closely.

8. Investment case

Coloplast is positioned as market leader in key markets. Due to economies of scale, high switching costs, and a strong brand, the company will be able to gain market share in the coming years. Earnings have grown by +7% annually since 2015/16. Around 90% of earnings are converted to FCF. Shareholders are in good hands, as Coloplast has a capable management team with skin in the game. With a FCF yield of 2,4% and a Div/SBB yield of 2,7%, the valuation seems reasonable.

Nice write up and clearly a quality company. A pharmacy isn't going to stock multiple brand due to shelf space so if they can continue to hold the shelf they will do well. Huge amount of debt going into a environment of higher rates for longer. Seems like 2-3 years to get the debt under control assume no more acquisitions. If management is acquisition trigger happy it could be a issue. Is is fair to combine "FCF yield of 2,4% and a Div/SBB yield of 2,7%" to get a combined shareholder yield of 5.1%? Large payout ratio as I assume that means a low reinvestment rate or Atos might give more reinvestment opportunities? Seems ideal for Terry Smith or what might he say?